More than

a bank

For more than 60 years, we have supported the development of small and medium-sized enterprises with medium- and long-term credit, leasing, financial consulting and extraordinary finance operations.

We act as a Corporate and Investment Bank through the operations of our branches to advise and assist companies in investments, drawing on national and European subsidised funds.

We offer a specialised project and public works finance desk for renewable energy and infrastructure investments.

Through minority equity stakes, we take on a role as a capital partner of our clients, aimed at development plans and possible subsequent capital market listings.

We act as advisor, arranger and underwriter of minibonds, following the issuing companies through all the necessary steps up to the issuance of the security.

We provide a specific consulting service for SMEs interested in approaching the capital market and listing in Euronext Growth Milan, with the support of IR TOP Consulting.

We offer private customers the opportunity to safely invest their savings in our online deposit account Conto Rifugio.

More than 60 years of experience

Establishment of Mediocredito

Year of establishment of Mediocredito Trentino Alto Adige as a corporation under public law of regional significance.

The Bank becomes an SPA

The bank becomes a Joint-Stock Company and the first branches open outside the region.

Social capital and governance

The regional cooperative credit assumes the governance of the bank. The local public authorities hold the majority of shares.

Core business: corporate

Focus of financial activities on corporate clients, creating specialised desks in structured and project finance.

Growth in efficiency and effectiveness

Reorganisation of activities and start of a process to improve efficiency and profitability indicators.

Our Identity

-

Experience

We are a team with many years’ experience in company financial analysis and technical evaluation of investments

-

People

We believe in continuous training, to grow in professionalism and to keep up with the changes and needs of the market

-

Solidity

CET1 is the most important indicator of a bank’s soundness. Ours, at 26.93%, ranks among the highest in the Italian banking system

-

Reports

We build strategic relationships with our customers to become trusted corporate advisors and offer customised financial solutions

-

Structured Finance

We are increasingly an investment bank with project finance, equity, minibonds and consulting for listing on Euronext Growth Milan.

-

Sustainability

We operate aware of our social and environmental responsibility with the will to create the conditions for sustainable development

Our numbers speak for themselves

- +1BN Loans to businesses

- +1500 Number of companies

- 26,93% CET 1

- 1,6% NPL

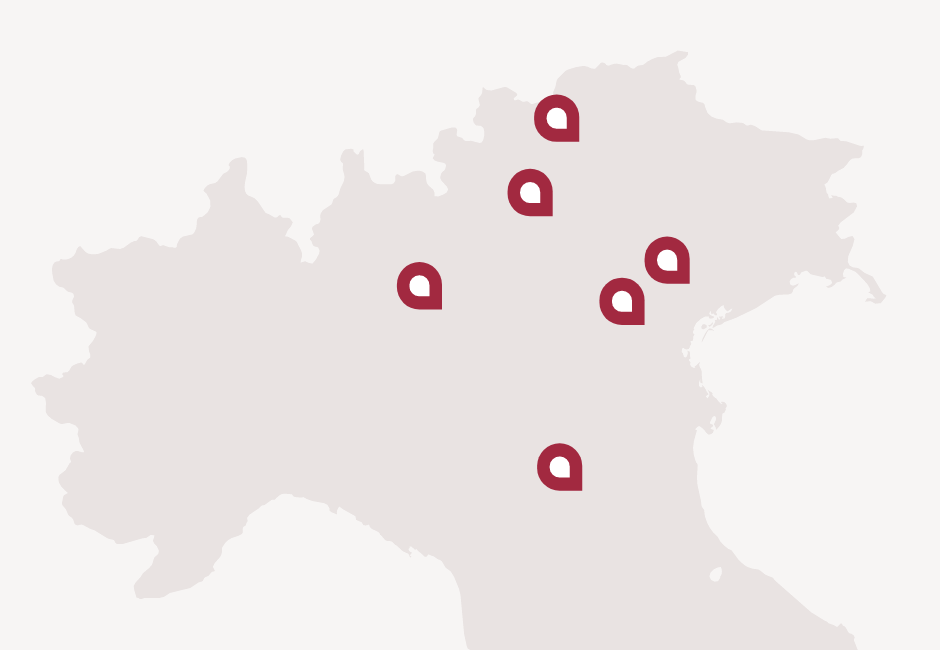

Always by your side

Six offices in Trento, Bolzano, Treviso, Padua, Bologna and Brescia